How Many Years Are Tax Records Kept . the conventional wisdom is you only need to keep bank, credit card and other personal finance documents for six. how long to keep your records. as an individual taxpayer in the uk, it is generally advised to retain income tax records for at least five years after the submission of your tax return. Employees and limited company directors. for individuals in the uk, the rule of thumb is to keep your tax records for at least 22 months after the end of the tax year they. how long must you keep your records? you must keep your records for at least 5 years after the 31 january submission deadline of the relevant tax year.

from www.thewendyslaughterteam.com

how long to keep your records. for individuals in the uk, the rule of thumb is to keep your tax records for at least 22 months after the end of the tax year they. the conventional wisdom is you only need to keep bank, credit card and other personal finance documents for six. how long must you keep your records? Employees and limited company directors. as an individual taxpayer in the uk, it is generally advised to retain income tax records for at least five years after the submission of your tax return. you must keep your records for at least 5 years after the 31 january submission deadline of the relevant tax year.

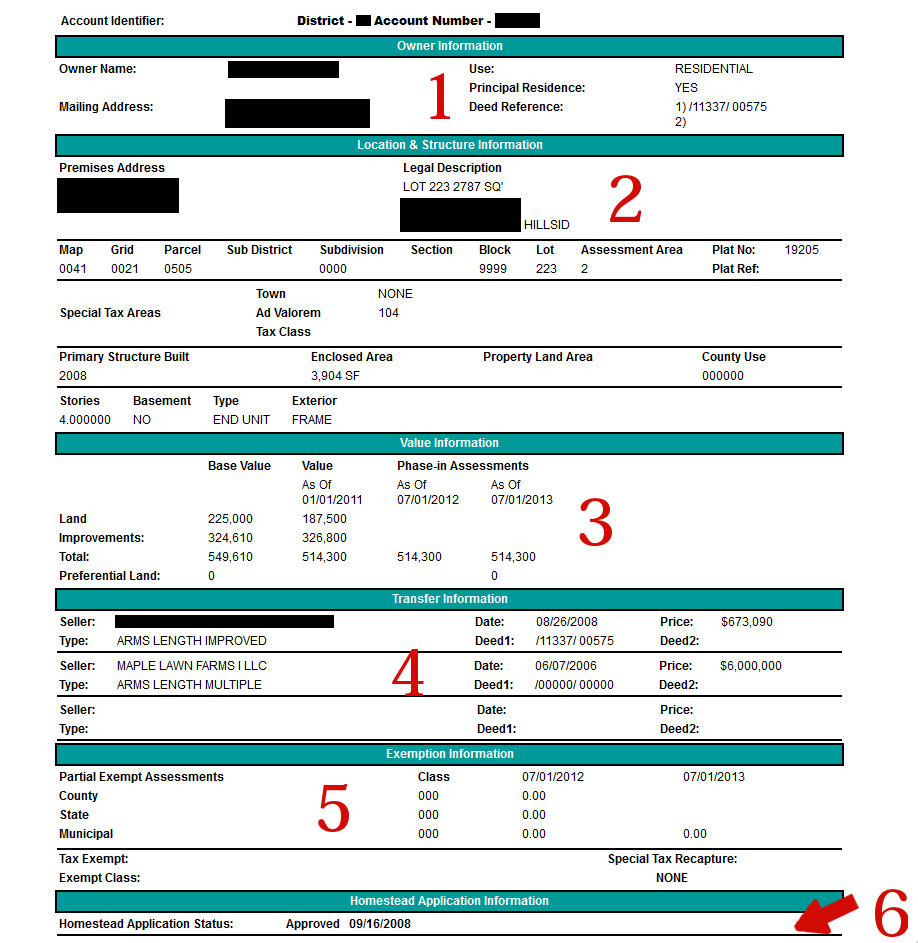

How to “read” a tax record — The Wendy Slaughter Team at Elevate Real

How Many Years Are Tax Records Kept you must keep your records for at least 5 years after the 31 january submission deadline of the relevant tax year. for individuals in the uk, the rule of thumb is to keep your tax records for at least 22 months after the end of the tax year they. how long to keep your records. as an individual taxpayer in the uk, it is generally advised to retain income tax records for at least five years after the submission of your tax return. the conventional wisdom is you only need to keep bank, credit card and other personal finance documents for six. you must keep your records for at least 5 years after the 31 january submission deadline of the relevant tax year. how long must you keep your records? Employees and limited company directors.

From www.youtube.com

How Long to Keep Your Old Tax Records The Wealthy Life YouTube How Many Years Are Tax Records Kept you must keep your records for at least 5 years after the 31 january submission deadline of the relevant tax year. how long to keep your records. the conventional wisdom is you only need to keep bank, credit card and other personal finance documents for six. for individuals in the uk, the rule of thumb is. How Many Years Are Tax Records Kept.

From vyde.io

What Business Records You Should Keep for Tax Purposes Vyde How Many Years Are Tax Records Kept how long to keep your records. you must keep your records for at least 5 years after the 31 january submission deadline of the relevant tax year. how long must you keep your records? Employees and limited company directors. as an individual taxpayer in the uk, it is generally advised to retain income tax records for. How Many Years Are Tax Records Kept.

From www.slideserve.com

PPT Chapter 8 PowerPoint Presentation, free download ID2688255 How Many Years Are Tax Records Kept how long to keep your records. how long must you keep your records? as an individual taxpayer in the uk, it is generally advised to retain income tax records for at least five years after the submission of your tax return. you must keep your records for at least 5 years after the 31 january submission. How Many Years Are Tax Records Kept.

From hxenmcigo.blob.core.windows.net

How Many Years To Keep Tax Records Usa at Bridget Browning blog How Many Years Are Tax Records Kept the conventional wisdom is you only need to keep bank, credit card and other personal finance documents for six. how long to keep your records. you must keep your records for at least 5 years after the 31 january submission deadline of the relevant tax year. how long must you keep your records? for individuals. How Many Years Are Tax Records Kept.

From theinsiderr.com

How Long Keep Tax Records? How Many Years Are Tax Records Kept as an individual taxpayer in the uk, it is generally advised to retain income tax records for at least five years after the submission of your tax return. how long to keep your records. for individuals in the uk, the rule of thumb is to keep your tax records for at least 22 months after the end. How Many Years Are Tax Records Kept.

From www.hrblock.com

How Long To Keep Tax Returns? H&R Block How Many Years Are Tax Records Kept as an individual taxpayer in the uk, it is generally advised to retain income tax records for at least five years after the submission of your tax return. the conventional wisdom is you only need to keep bank, credit card and other personal finance documents for six. you must keep your records for at least 5 years. How Many Years Are Tax Records Kept.

From wtcca.com

Know the Rules on How Long to Keep Tax Records in Canada How Many Years Are Tax Records Kept for individuals in the uk, the rule of thumb is to keep your tax records for at least 22 months after the end of the tax year they. Employees and limited company directors. you must keep your records for at least 5 years after the 31 january submission deadline of the relevant tax year. as an individual. How Many Years Are Tax Records Kept.

From www.organizedisland.com

Organizing Tax Records Organized Island How Many Years Are Tax Records Kept how long to keep your records. Employees and limited company directors. the conventional wisdom is you only need to keep bank, credit card and other personal finance documents for six. for individuals in the uk, the rule of thumb is to keep your tax records for at least 22 months after the end of the tax year. How Many Years Are Tax Records Kept.

From fwnaccounting.com

How long do you have to keep tax records? » FWN Accounting How Many Years Are Tax Records Kept how long must you keep your records? the conventional wisdom is you only need to keep bank, credit card and other personal finance documents for six. Employees and limited company directors. as an individual taxpayer in the uk, it is generally advised to retain income tax records for at least five years after the submission of your. How Many Years Are Tax Records Kept.

From www.fedsmith.com

What Tax Records Should You Keep? How Many Years Are Tax Records Kept the conventional wisdom is you only need to keep bank, credit card and other personal finance documents for six. how long must you keep your records? you must keep your records for at least 5 years after the 31 january submission deadline of the relevant tax year. for individuals in the uk, the rule of thumb. How Many Years Are Tax Records Kept.

From worthtax.com

How Long Should You Keep Old Tax Records? How Many Years Are Tax Records Kept how long to keep your records. Employees and limited company directors. as an individual taxpayer in the uk, it is generally advised to retain income tax records for at least five years after the submission of your tax return. you must keep your records for at least 5 years after the 31 january submission deadline of the. How Many Years Are Tax Records Kept.

From hxenmcigo.blob.core.windows.net

How Many Years To Keep Tax Records Usa at Bridget Browning blog How Many Years Are Tax Records Kept the conventional wisdom is you only need to keep bank, credit card and other personal finance documents for six. how long to keep your records. how long must you keep your records? you must keep your records for at least 5 years after the 31 january submission deadline of the relevant tax year. as an. How Many Years Are Tax Records Kept.

From www.forbes.com

Here’s How Long You Should Keep Your Tax Records Forbes Advisor How Many Years Are Tax Records Kept as an individual taxpayer in the uk, it is generally advised to retain income tax records for at least five years after the submission of your tax return. you must keep your records for at least 5 years after the 31 january submission deadline of the relevant tax year. for individuals in the uk, the rule of. How Many Years Are Tax Records Kept.

From hxenmcigo.blob.core.windows.net

How Many Years To Keep Tax Records Usa at Bridget Browning blog How Many Years Are Tax Records Kept you must keep your records for at least 5 years after the 31 january submission deadline of the relevant tax year. how long must you keep your records? for individuals in the uk, the rule of thumb is to keep your tax records for at least 22 months after the end of the tax year they. Employees. How Many Years Are Tax Records Kept.

From cruseburke.co.uk

How Long Do Businesses Need To Keep The Tax Records? CruseBurke How Many Years Are Tax Records Kept as an individual taxpayer in the uk, it is generally advised to retain income tax records for at least five years after the submission of your tax return. how long to keep your records. Employees and limited company directors. you must keep your records for at least 5 years after the 31 january submission deadline of the. How Many Years Are Tax Records Kept.

From twitter.com

IRSnews on Twitter "IRSTaxTip Make sure to keep your tax records for How Many Years Are Tax Records Kept the conventional wisdom is you only need to keep bank, credit card and other personal finance documents for six. Employees and limited company directors. you must keep your records for at least 5 years after the 31 january submission deadline of the relevant tax year. for individuals in the uk, the rule of thumb is to keep. How Many Years Are Tax Records Kept.

From www.pinterest.com

How Long To Keep Your Tax Returns and Records Good Money Sense Tax How Many Years Are Tax Records Kept how long must you keep your records? Employees and limited company directors. for individuals in the uk, the rule of thumb is to keep your tax records for at least 22 months after the end of the tax year they. the conventional wisdom is you only need to keep bank, credit card and other personal finance documents. How Many Years Are Tax Records Kept.

From exoqsvrfx.blob.core.windows.net

Tax Records Retention Canada at Reggie Clark blog How Many Years Are Tax Records Kept as an individual taxpayer in the uk, it is generally advised to retain income tax records for at least five years after the submission of your tax return. Employees and limited company directors. the conventional wisdom is you only need to keep bank, credit card and other personal finance documents for six. you must keep your records. How Many Years Are Tax Records Kept.